Several federal proposals circulating in Washington could threaten New York’s health care system and local communities. These cuts to essential health care would harm New Yorkers, hospitals, health care providers, insurance companies, and the State’s economy and budget. Around 8.6 million New Yorkers have and rely on publicly funded health insurance and may be affected by these federal threats.

Across New York, Medicaid provides insurance for almost half of all children and covers nearly half of all births. It is an incredibly important source of financial stability for rural and safety-net hospitals and is the largest payer of behavioral health services. Cuts to this program would force providers to cut back or eliminate services and would take away lifesaving health care for many working people. In response to these federal threats, stakeholders around the State came together to urge the New York Congressional Delegation to ensure that these proposals to reduce Medicaid funding are not included in this year’s budget reconciliation process.

HCFANY breaks down how these federal threats affect New Yorkers statewide and by Congressional District. Click the link below to download a one-pager you can use to reach out to your Member of Congress to ask them to protect access to health care in New York.

Find your district in the list below to see how these threats affect each district and its residents:

- PDF with all Congressional Districts

- District 1 One-Pager

- District 2 One-Pager

- District 3 One-Pager

- District 4 One-Pager

- District 5 One-Pager

- District 6 One-Pager

- District 7 One-Pager

- District 8 One-Pager

- District 9 One-Pager

- District 10 One-Pager

- District 11 One-Pager

- District 12 One-Pager

- District 13 One-Pager

- District 14 One-Pager

- District 15 One-Pager

- District 16 One-Pager

- District 17 One-Pager

- District 18 One-Pager

- District 19 One-Pager

- District 20 One-Pager

- District 21 One-Pager

- District 22 One-Pager

- District 23 One-Pager

- District 24 One-Pager

- District 25 One-Pager

- District 26 One-Pager

Call key members of Congress today and ask them to stop health care cuts to pay for millionaires’ taxes! Republicans only have a slight 3-vote majority in the House of Representatives. These New York members of Congress are critical in preventing these proposed cuts. These Congress members need to hear from New Yorkers why they need to vote to protect our access to health care. click here.

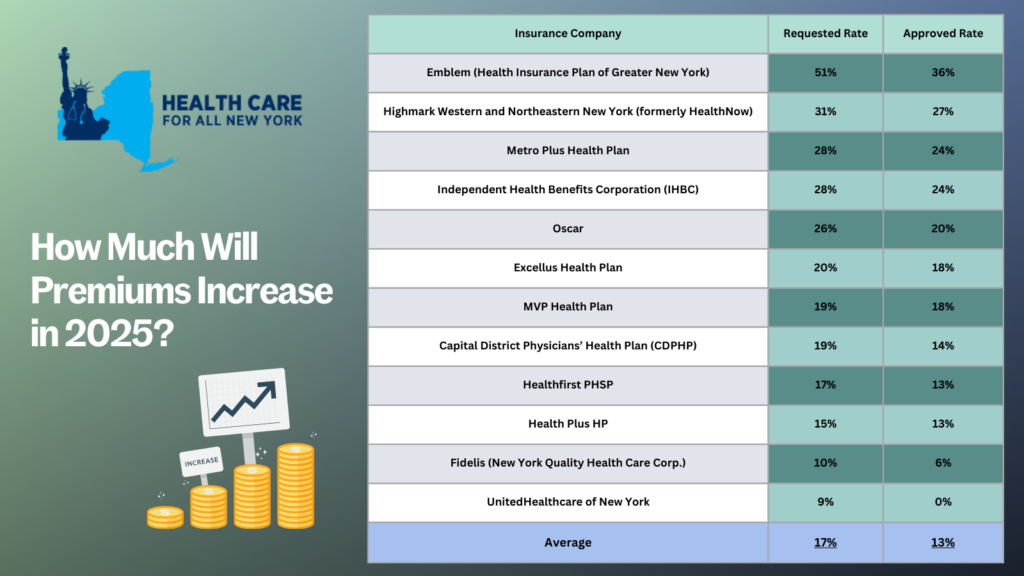

New Yorkers anticipating health insurance premiums in the individual market will face

disappointing developments in 2025. The latest data shows that individual market rates

are expected to increase by an average of 13 percent next year. Insurance carriers initially

requested a 17 percent average rate surge for 2025, but through New York’s prior approval

process, the Department of Financial Services has marginally trimmed this figure down. The table below compares health plans’ initial rate requests with rates that were ultimately approved, providing insight into how this process impacts your healthcare costs (you can also review our detailed comments on each carrier’s rate request).

The prior approval process acts as an important safeguard; and while expanded advanced premium tax credits—enacted through the American Rescue Plan during the COVID-19 pandemic—have helped make health insurance more affordable, these tax credits are set to expire in 2025. This 13 percent increase will be a financial burden for many New Yorkers. New York should consider additional strategies to protect consumers from steep premium increases beyond the rate review process. States—such as Connecticut, Delaware, Massachusetts, Nevada, New Jersey, Oregon, Rhode Island, and Washington—have already taken steps in this direction, setting up Health Care Cost Containment task forces or agencies.

If you’re concerned about health insurance costs, there’s good news. Most New Yorkers

purchasing their own health coverage are eligible for subsidies that can help. To explore

your options and learn more about available subsidies, visit the NY State of Health

enrollment site. If you need help switching plans or finding affordable health insurance, the

Navigators program offers free, unbiased guidance and can help you understand your

premium assistance and coverage options. You can contact Navigators through the CSS

Navigator Network at 888-614-5400 or email enroll@cssny.org. Additionally, you can reach out to NY State of Health assistors online or by calling 855-355-5777.

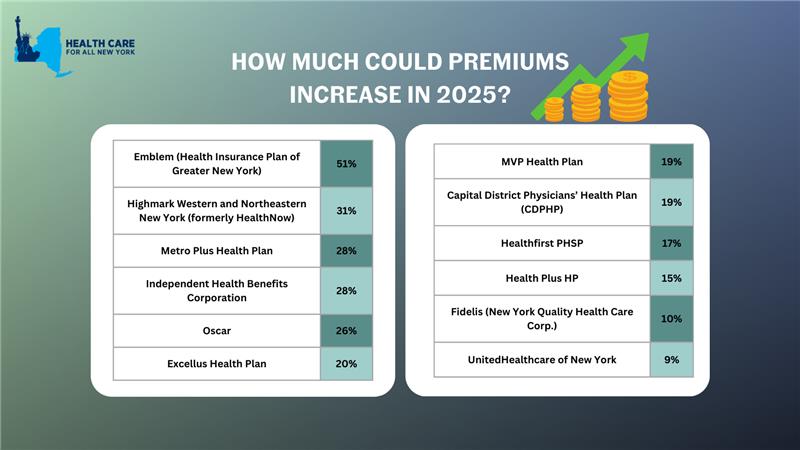

New York’s individual market premiums might increase by up to 17 percent in 2025. New York’s twelve individual market carriers are requesting increases ranging from 9 percent by MVP to a shocking 51 percent by Emblem. These requested increases far surpass requests from carriers in other states.

In our comments, HCFANY breaks down why DFS should curb each carrier’s specific rate requests to protect patients from another unaffordable increase in health care costs. Find your carrier in the list below to see what we had to say:

- CDPHP

- Emblem

- Excellus

- Fidelis

- Healthfirst

- HealthPlus

- Highmark

- Independent Health

- Metroplus

- MVP

- Oscar

- United

The NY State of Health (NYSOH) is New York’s Marketplace, an online portal created to help peopel shop for health insurance through the Affordable Care Act. New York has worked hard to make NYSOH easy to use. While there have been hiccups here and there, the Department of Health announced today that a record breaking 4.9 million people used NYSOH to enroll in health coverage during this year’s open enrollment! That’s more than 25 percent of New Yorkers, and it includes 150,000 people who used NYSOH for the first time.

New Yorkers can use NYSOH to enroll in the following programs:

- Medicaid – This is New York’s public insurance program for low-income people. Enrollment into Medicaid can happen year round. This year 3.4 million New Yorkers enrolled in Medicaid using NYSOH.

- Essential Plan – This is another public plan for people who earn a bit too much for Medicaid but not enough to purchase private insurance. Almost 800,000 New Yorkers enrolled this year.

- Child Health Plus – This covers children up to age 19 whose families make too much for public programs but who cannot easily afford full coverage. About 450,000 kids enrolled in CHP this year!

- Qualified Health Plans – These are private plans that follow the ACA’s rules (such as accepting people with pre-existing conditions and covering the ten essential benefits). About 273,000 New Yorkers purchased a QHP this year. Many (58 percent) did so with help from federal subsidies they qualify for based on income. But a large number (114,000) still found plans they liked without help – a good sign that New York’s individual market is becoming more and more stable over time.