HCFANY’s Response to the 2025-26 One-House Budgets

With the recent release of the Senate and Assembly One-House budgets, HCFANY is excited to see some of our policy agenda items included. However, HCFANY is also disappointed that key proposals to protect and improve health care coverage for many New Yorkers were left out. Read below for HCFANY’s response to the One-House budgets:

HCFANY supports the following proposals in either the Assembly or the Senate One-House Budget or both:

- Strengthen maternal and reproductive health care access.

- Cover more lactation support services under Medicaid, including allowing certified lactation consultants to enroll as Medicaid providers and covering breast pump supplies.

Primary Care spending: In the United States, less than five cents of every dollar we spend on health care goes to primary care doctors and nurses, even though they handle a third of health care visits. In New York, nearly 70 percent of all emergency room visits are non-emergent and could be better treated in a primary care setting, over double the national rate. HCFANY strongly supports the inclusion of the provisions of the Primary Care Investment Act in the Senate’s One-House Budget, which requires insurance carriers to increase spending on primary care by one percent each year until they reach a target of 12.5 percent. Investment in primary care can reduce the prevalence of chronic diseases and overall health care spending. According to a recently released survey on health care affordability, 79 percent of New Yorkers support requiring insurance carriers to gradually increase spending on primary care. Many other states have also enacted similar policies requiring increased primary care spending (e.g., Colorado, Delaware, Oregon, and Rhode Island). New York should follow suit.

Maternal, reproductive, and lactation care: In New York, Black mothers are five times more likely to have a pregnancy-related death than their White counterparts. HCFANY strongly supports initiatives that tackle racial inequities within New York’s health care system and is excited to see greater and continued support from New York’s Legislature for maternal and reproductive health care. Almost half of births in New York are covered under Medicaid, and with current federal threats that may cut funding for Medicaid—providing health care access to around 7 million New Yorkers. New York can use the budget to safeguard access to care for many New York mothers.

HCFANY supports the following initiatives introduced in the Executive Budget but urges the Legislature and the Governor to adopt slight modifications in the final budget:

- Strengthen the New York Department of Health’s (DOH) oversight of material health care transactions and require public disclosure and allow public participation during the health care transaction process. A material health care transaction includes mergers, acquisitions, or a form of partnership with the purpose of administering contracts with health plans, third-party administrators, pharmacy benefit managers, or health care providers. What is excluded from this definition is partnerships for clinical trials or transactions that result in a health care entity increasing its total gross in-state revenue by less than $25 million.

HCFANY supports granting the DOH authority to determine a health care transaction’s potential market and cost impact and the post-closure impact on costs, quality, access, health equity, and competition. Additionally, the Executive budget proposes that transactions require written notice before the transaction closes to include whether either a party or parent company owns a health care entity that has closed, is in the process of closing, or has reduced its services provided. In the Senate’s One-House budget, HCFANY supports the addition of extending the notification time frame for closures from 60 to 90 days.

HCFANY, separately, urges the Legislature to make amendments to the language to improve transparency and consumer engagement for this process by (1) requiring full public disclosure of the material transactions, (2) extending the time to file such a transaction, and (3) allowing the public to provide input on the proposed transactions to the DOH, similar to the provisions of the Local Input for Community Healthcare Act (LICH) (S1226/A6004) passed by both houses of the Legislature and vetoed by the Governor last year. The LICH bill would require the approval of closures of a hospital or maternity, emergency, or mental health services to consider findings from a Health Equity Impact Assessment, and closures must be reviewed in public sessions by the State’s Public Health and Health Planning Council.

HCFANY is disappointed that the following initiatives are not included in the One-House Budgets:

- Include the No Blank Checks Act (S6375), which would create a uniform patient financial liability form that includes a good faith estimate of what a patient owes financially for the care or service they will receive.

- Include the Fair Pricing Act (S705/A2140), which would limit prices on routine medical services to 150% of the Medicare rate.

- Redistribute some of the $1.4 billion from Managed Care Organization (MCO) tax revenue for direct patient support and a rainy-day fund.

No Blank Checks: When patients walk into an appointment for a health care service, they are often required to sign a form agreeing to pay for any charges not covered by my insurance before they receive any care. This form legally binds them to pay for the service they get without knowing the outcome, how much will be covered by insurance, or whether their provider will bill correctly. It is essentially a blank check. The provisions of the No Blank Checks Act would create a uniform patient financial liability form that includes a good faith estimate of a patient’s financial obligation for their care. If patients are liable to pay for the service beforehand, health care services should inform them of how much it will cost. New Yorkers need greater price transparency, and many agree, as 92 percent of New Yorkers endorse requiring hospitals and doctors to provide up-front cost estimates to consumers.

Fair Pricing: According to 32BJ Health Fund claims data, the exact same service can cost $1,000 more at a hospital-owned outpatient department compared to a doctor’s office. Spending on hospital care is the biggest contributor to rising health care spending in New York, rising twice as fast as income and four times as fast as inflation. Rising prices directly affect New Yorkers as around two-thirds of them have experienced a health care affordability burden this year, with even more worried about affording care in the future. The Fair Pricing Act, which caps prices for routine services at a reasonable 150% of Medicare rates, would save the State an estimated $1.1 billion, $213 million of which would be saved annually by New Yorkers in reduced out-of-pocket costs. It is also supported by 86% of New Yorkers.

MCO tax: The MCO tax allows the State to draw down federal funds by taxing Medicaid and the Essential Plan MCOs to receive a federal match. The State then reimburses MCOs to make them whole and pockets the additional revenue. The Executive budget is allocating a significant portion of this revenue to hospitals. However, HCFANY urges the Governor and the Legislature to come together to reallocate some of these funds to support patients directly in the final budget. With federal threats to cut funding to Medicaid and Affordable Care Act health programs, the State can use this tax revenue to protect New Yorkers’ access to health care coverage by allocating some of this revenue to principal reserves or rainy-day funds. Medicaid provides health and financial security for seniors, children, and working-class families, and it is a critical source of funding for hospitals, clinics, community health centers, and long-term care facilities. The State should use the MCO tax revenue as an opportunity to prepare for potential cuts to federal health programs, including Medicaid.

- Worried about federal threats to health coverage? Call key New York Members of Congress today and ask them to stop federal threats to health care in order to pay for tax breaks for millionaires. They need to hear from New Yorkers on why they need to vote to protect our access to health care: click here.

- Learn how federal threats affect New York State and each of its congressional districts: click here.

Stay tuned for our comments on the final State budget releases.

Several federal proposals circulating in Washington could threaten New York’s health care system and local communities. These cuts to essential health care would harm New Yorkers, hospitals, health care providers, insurance companies, and the State’s economy and budget. Around 8.6 million New Yorkers have and rely on publicly funded health insurance and may be affected by these federal threats.

Across New York, Medicaid provides insurance for almost half of all children and covers nearly half of all births. It is an incredibly important source of financial stability for rural and safety-net hospitals and is the largest payer of behavioral health services. Cuts to this program would force providers to cut back or eliminate services and would take away lifesaving health care for many working people. In response to these federal threats, stakeholders around the State came together to urge the New York Congressional Delegation to ensure that these proposals to reduce Medicaid funding are not included in this year’s budget reconciliation process.

HCFANY breaks down how these federal threats affect New Yorkers statewide and by Congressional District. Click the link below to download a one-pager you can use to reach out to your Member of Congress to ask them to protect access to health care in New York.

Find your district in the list below to see how these threats affect each district and its residents:

- PDF with all Congressional Districts

- District 1 One-Pager

- District 2 One-Pager

- District 3 One-Pager

- District 4 One-Pager

- District 5 One-Pager

- District 6 One-Pager

- District 7 One-Pager

- District 8 One-Pager

- District 9 One-Pager

- District 10 One-Pager

- District 11 One-Pager

- District 12 One-Pager

- District 13 One-Pager

- District 14 One-Pager

- District 15 One-Pager

- District 16 One-Pager

- District 17 One-Pager

- District 18 One-Pager

- District 19 One-Pager

- District 20 One-Pager

- District 21 One-Pager

- District 22 One-Pager

- District 23 One-Pager

- District 24 One-Pager

- District 25 One-Pager

- District 26 One-Pager

Call key members of Congress today and ask them to stop health care cuts to pay for millionaires’ taxes! Republicans only have a slight 3-vote majority in the House of Representatives. These New York members of Congress are critical in preventing these proposed cuts. These Congress members need to hear from New Yorkers why they need to vote to protect our access to health care. click here.

The season of giving is coming early for many New Yorkers seeking hospital care this year. As of last month, amendments to New York’s Hospital Financial Assistance Law (HFAL) will make it easier to apply for and cover more patients under financial assistance programs. The HFAL, also known as Manny’s Law, was implemented in 2006 in response to the death of Manny Lanza, 24. Lanza passed away after being denied life-saving surgery due to his uninsured status.

Financial assistance programs help many patients receive affordable care on a sliding fee scale based solely on their household income. This includes patients who are uninsured or those with insurance, but medical costs are a big strain on their income. Rising hospital prices in recent years have left many patients unable to afford the care they need, often leading them to incur medical debt. A 2023 Urban Institute reported that 740,000 New Yorkers had medical debt, with nearly half of them owing $500 or more. This updated HFAL will streamline the process and expand the eligibility of hospital financial assistance. New Yorkers will finally be able to have some more relief from medical debt and rising healthcare costs.

The following changes will be made to HFAL and medical debt in New York.

- All hospitals licensed by the New York State Department of Health (NYSDOH) are required to use a Uniform Hospital Financial Assistance form and inform patients of financial assistance availability in writing during registration and at discharge (regardless of the hospital’s participation in the Indigent Care Pool). Eligibility will not consider the patient’s immigration status. Before this amendment, many patients were never informed financial assistance existed and many hospitals requested information that was not legally required, like Social Security Numbers or tax returns, which often scared patients away from applying.

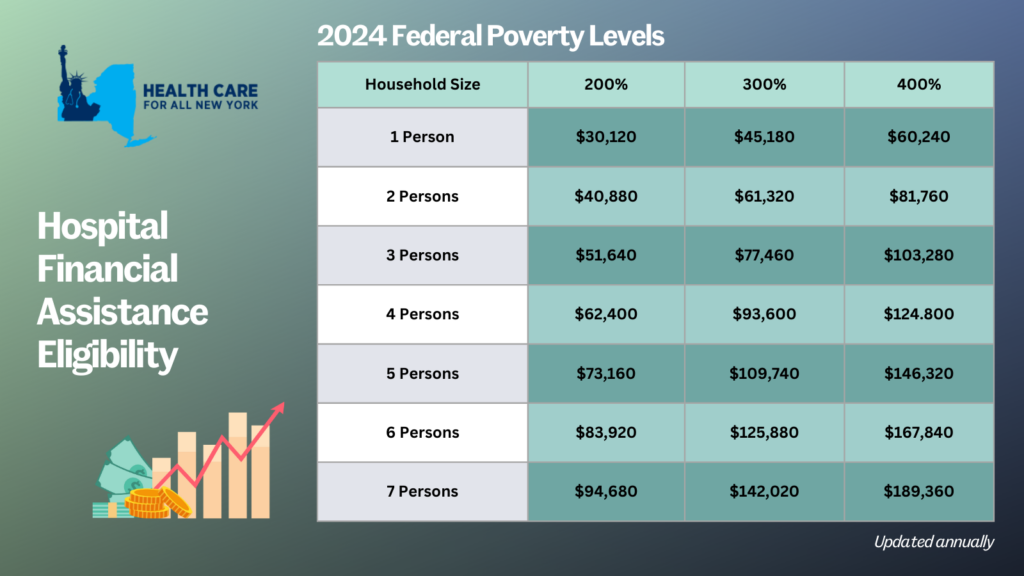

- Patient eligibility for financial assistance will be expanded for those uninsured and underinsured. Under the new law, being underinsured is defined as patients whose paid medical expenses, excluding insurance premiums, exceeds 10 percent of their income within the last 12 months. Uninsured patients will now qualify if their household earns up to 400 percent of the federal poverty level (FPL) and will receive free or discounted care based on a sliding scale (see the table below for eligibility guidelines based on household size and the payment sliding scale). These guidelines will be solely based on the FPL and are updated through the Poverty Guidelines | ASPE.

- Individuals can now apply for hospital financial assistance at any time.

- Hospitals may not sell patients’ debt to third party entities like debt collection agencies. Often these agencies use aggressive and threatening practices to make patients pay medical debt.

- Hospitals are prohibited from bringing lawsuits against patients earning up to 400 percent FPL to collect unpaid medical bills. And lawsuits to collect unpaid balances cannot be brought until 180 days after the first medical bill. Lawsuits have disproportionately affected people of color and low-income residents. For example, according to a 2024 Community Service Society of New York report, over a third of lawsuits filed by State-run hospitals were filed against patients who lived in zip codes where residents are disproportionately people of color. Additionally, nearly all these cases were filed against patients that should have been eligible for hospital financial assistance.

- To measure this impact, hospitals will report to the DOH the number of people that have applied for financial assistance annually including age, gender, race, ethnicity, and insurance status.

With this series of reforms, more New Yorkers will be able to receive affordable hospital care and reduce their chances of incurring medical debt. The HFAL was a landmark reform back in 2006 and has been far improved with these amendments.

Here’s a copy of the form hospitals must use now.

If you need assistance in applying for hospital financial assistance, contact Community Health Advocates at 888-614-5400.

The Department of Financial Services released its final 2022 rate decisions today, and once again our prior approval law has resulted in huge savings for New Yorkers. Individual market insurers requested an average premium increase of 11.2% this year. After reviewing their requests, DFS knocked that down to just 3.7%, a 67% decrease! That means consumers will save over $138 million in 2022. Small group plans requested an average rate increase of 14%, which was reduced to 7.6%. That reduction will save small business owners over $468 million in 2022.

In the individual market the biggest reductions were for Healthfirst (from a requested increase of 34.4% to an approved increase of 9.7%) and Highmark Western and Northeastern NY (from a requested increase of 18.1% to an approved increase 6.2%. Three plans will lower their rates in 2022: IHBC by 4.4%, MetroPlus by 3.9%, and Fidelis (by 0.1%). These final rates are an average across all the individual plans offered by each carrier.

“Prior approval” means that insurers submit requests to state regulators explaining what they plan to charge next year. The Department’s job is keeping premiums as low as possible while making sure that plans stay solvent. The rate applications include information on the plans’ costs during the current year (though this year they used 2019 data because 2020 was such an outlier) and assumptions the plans have about costs next year. DFS looks at this data and especially at the assumptions plans make to see if they are in line with other sources. For example, the plans provide an estimate of medical trend. Medical trend is the change in what plans spend on health services for members each year due to changes in prices for those services and how often members receive health care. DFS frequently disallows trend estimates that are too high with no justification. DFS has also capped profit in the past to keep rates down. For example, last year it capped profit at 0.5% for all plans.

Prior approval in New York is a public process and members of the public are able to submit comments on the rate requests. You can read our comments on each plan’s request here. This year, many commenters talked about the financial difficulties they are experiencing because of the pandemic. Others talked about paying higher premiums every year but struggling to find doctors and receive care. Some asked why costs aren’t going down given cheaper ways of providing care like telemedicine or the new customers plans will get in 2022 because of the American Rescue Plan’s higher premium subsidies. You can find your individual market plan and the public’s comments on it at these links: