HCFANY is thankful to have the opportunity to testify at the 2026 Joint Legislative Budget Hearing on Health. Find HCFANY’s detailed Executive FY27 Testimony here. The Executive Budget includes many proposals to help protect and enhance New Yorkers’ access to affordable health coverage.

HCFANY’s budget testimony covers three topics:

- Protect and improve health coverage

- Regulate prices to create a more affordable health care system for New Yorkers

- Robustly fund consumer assistance and enrollment programs and increase Article 6 funding to help New Yorkers navigate new complex hurdles

(I) Protect and Improve Health Coverage

The enactment of HR 1 will drastically alter eligibility and funding for health insurance, leaving an estimated 1.5 million New Yorkers at risk of losing their coverage. Coverage losses for individuals on the Essential Plan may go into effect as soon as July 2026, so it is imperative that the State have a plan in place to mitigate these federal cuts.

- Support the transition from 1332 Waiver to 1331 Basic Health Plan (BHP) to allow 609,000 lawfully present immigrants to stay covered.

If the federal government approves this change, 444,000 people enrolled in New York’s Essential Plan with incomes between 200-250 percent of the Federal Poverty Level (FPL) will become newly ineligible for the Essential Plan mid-year. The State should provide coverage options and financial support for this population: 6,000 individuals with Deferred Action for Childhood Arrival (DACA) immigration status or who are Permanently Residing Under Color of Law (PRUCOL), and 30,000 lawfully present immigrants with incomes over 200 percent FPL. These policy options are detailed in Community Service Society’s recently released report: Mitigating the Impact of HR 1 on New York’s Health Insurance Landscape: Four Policy Proposals to Preserve Coverage.

- Delay the repeal of continuous coverage of children up to age six. (Health and Mental Hygiene [HMH] Article VII, Part M)

The federal government has made it clear that New York’s continuous coverage program for children up to age six will be discontinued. The Executive Budget includes a proposal to repeal this program on July 1, 2026. However, New York’s Medicaid 1115 waiver does not expire until March 2027.

HCFANY recommends delaying the repeal until January 1, 2027, to ensure a smooth transition and keep these children covered for as long as possible.

- Support the reforms to prior authorization, with some recommendations. (Transportation, Economic Development, and Environmental Conservation [TED] Article VII, Part HH)

The Budget requires additional information to be added to the Department of Financial Services (DFS) Consumer Guide, which helps consumers compare and select health plans offered in the New York Marketplace. HCFANY supports this addition but critically notes that the Consumer Guide currently does not report on plans that cover 80 percent of New Yorkers in the individual market. The Consumer Guide, and its additions, should be expanded to serve all consumers in the individual market.

HCFANY supports language in the budget that expands the period insurers must cover out-of-network services for new enrollees, also known as continuity of care. In addition, HCFANY supports the budget proposal to improve consumer access to information on health plans’ formulary drug lists, helping patients understand which prescription drugs are covered under their plan.

- Enact the New York Health Act S3425|A1466, which would make many of the above changes unnecessary and better address the long-term health care needs of New Yorkers.

(II) Regulate Prices to Create a More Affordable Health Care System for New Yorkers

Over the past few decades, New York’s health care spending has increased rapidly, and the State ranks second nationally in highest health care expenditures and premiums. Hospital prices are a primary contributor to these high health care costs.

The FPA would cap payments at 150 percent of the Medicare rate for a defined list of low-complexity procedures. This would reduce cost disparities between hospital and non-hospital providers, such as doctors’ offices. Currently, a new patient office visit costs around $88 at a non-hospital site but can cost $436 (540 percent of the Medicare rate) in a hospital outpatient department. Adopting the Fair Pricing Act could save New York $1.14 billion annually, including $213 million in reduced out-of-pocket costs for consumers with commercial insurance. The Community Service Society recently released a brief, “How the Fair Pricing Act’s Site Neutral Policy Boosts Health Care Affordability by Ensuring Savings Will Be Passed Through to Patients and Payers“, exploring proposed solutions to curb this trend and make health care more affordable for New Yorkers.

- Invest in primary care by including provisions from the Primary Care Investment Act (PCIA) S1634|A1915A.

The PCIA would require New York to measure and report the current percentage of its health care expenditures that are spent on primary care. It would also require insurers to gradually increase spending by 1 percent each year until reaching a benchmark of spending at least 12.5 percent of their overall health spending on primary care. Nationally, only 4.6 percent of health care spending is spent on primary care, despite primary care accounting for nearly half of office visits each year. Adopting provisions from the PCIA will reduce health care costs, improve patient outcomes, and promote health equity.

- Create an independent New York Office of Health Care Affordability.

California’s Office of Health Care Accountability is an independent entity that regulates the state’s health care spending growth, quality, and market consolidation. It also requires its members not to receive compensation from health care entities. Currently, New York’s Public Health and Health Planning Council (PHHPC) is comprised of political appointees affiliated with hospitals and other health care industry representatives.

HCFANY recommends that the Legislature consider creating an independent office to address long-term structural issues to improve health care affordability in New York.

- Support strengthening the Department of Health’s oversight of health care transactions, with further recommendations for transparency. (HMH Article VII, Part H).

HCFANY supports tracking the impact of material transactions on health care costs, quality, access, health equity, and competition. HCFANY urges the Legislature to go further and require an annual summary of this impact to be publicly posted for advocates and consumers to understand the impact of these transactions.

HCFANY also supports the additional requirements for written notice of health care transactions and the utilization of cost and market impact review (CMIR) for material transactions. However, HCFANY urges the Legislature to expand the language to require public posting of documents related to the review process and results.

(III) Robustly Fund Consumer Assistance and Enrollment Programs and Increase Article 6 Funding

Given devastating cuts to federal health programs, consumer assistance advocates and navigators are more important than ever to help New Yorkers through coverage transitions and to reduce barriers in accessing affordable care.

- Increase funding for health insurance enrollment navigators.

The Navigator program, predominantly run through trusted community-based organizations (CBOs), helps New Yorkers enroll, keep, and use their health insurance. Navigators provide unbiased, personal assistance year-round and speak over 40 languages.

HCFANY is grateful that the Governor’s budget includes $28.3 million for Navigators and urges the Legislature to fund the Navigator program at $38 million to guarantee continued high-quality enrollment services. The State should also allocate $5 million in grants to CBOs to conduct outreach in underserved communities.

- Maintain funding for Community Health Advocates (CHA).

CHA helps individuals with any type of health insurance access in-network care, resolve billing issues, avoid medical debt, appeal coverage denials, and address other barriers to obtaining affordable medical care. In FY 24-25, CHA saved consumers $25 million, yielding a 407% return on investment.

HCFANY is grateful that the Governor’s budget includes $5.5 million for CHA and urges the Legislature to allocate an additional $1.7 million to maintain CHA’s funding at its current $7.2 million.

- Increase Article 6 funding in New York City.

Under Article 6, New York City is reimbursed for essential public health services at a lower rate than all other localities in the State, receiving just 20 percent for spending above its base grant compared to 36 percent for all other local health departments.

HCFANY strongly supports increasing Article 6 funding for NYC.

Stay tuned, as HCFANY will review the Governor’s 30-day amendments, the One-House bills, and the finalized FY27 Executive Budget.

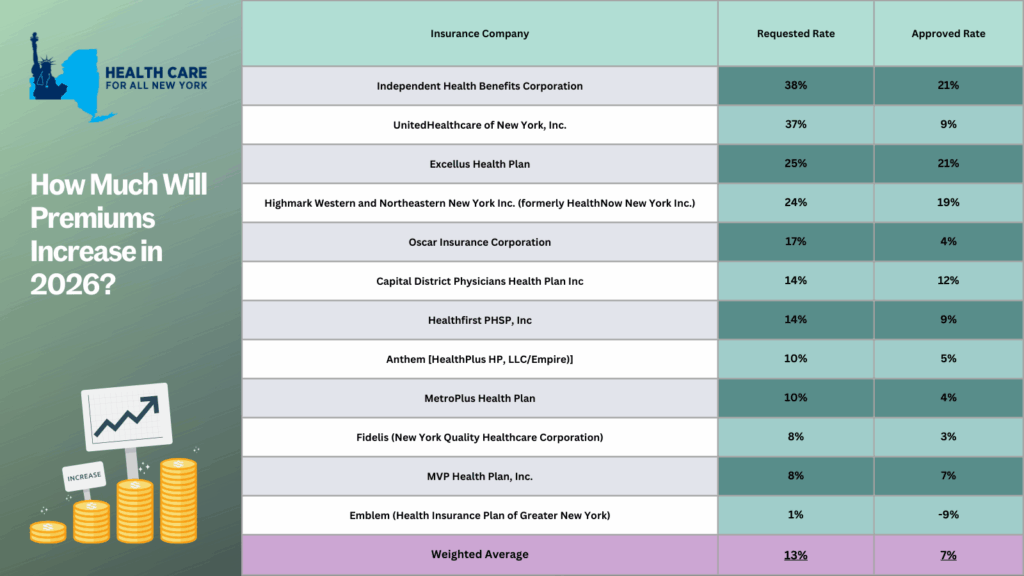

The New York Department of Financial Services (the Department) reduced the requested rates by insurance carriers for the individual market by 48 percent for 2026. Carriers initially requested a 13 percent average rate surge, but through New York’s prior approval process, the Department trimmed this figure down to an average of seven percent. Without this process, rates requested by insurance carriers would require New Yorkers to pay an average of $1,291 more annually, or $108 per month, in premiums next year. With the newly approved rates from the Department, the annual increase in premiums is now $678, or $57 per month, for next year.

The table below compares health plans’ initial rate requests with rates that were ultimately approved, providing insight into how this process impacts your health care costs (you can also review our detailed comments on each carrier’s rate request here).

The prior approval process serves as an essential safeguard to curb rising health care costs. For the past two years, the State has approved, on average, steep premium increases of 13% in 2025 and 12% in 2024. With a record number of public comments submitted by consumers, the State reduced the high premium increases requested by individual market insurance carriers. Despite these efforts, any rise in premiums for New Yorkers makes health care even less affordable for consumers, especially with current federal proposals that threaten New York’s health care system:

- Enhanced premium tax credits are set to expire at the end of this year. Unless Congress decides to extend these credits, New Yorkers—who previously received them—can expect a monthly average premium increase of $114.

- New Centers for Medicare and Medicaid Services guidance, set to take effect in 2027, will take away health coverage from 750,000 New York children, from ages 0 to 6, on Medicaid or Child Health Plus.

- The so-called “One Big, Beautiful Bill” is estimated to leave around 1.5 million New Yorkers without health coverage. Learn more about how federal threats impact the State here.

New York should consider additional strategies to protect consumers from steep premium increases beyond the rate review process. HCFANY recommends the State to implement many proposals in HCFANY’s 2025 Policy Agenda that will help patients get affordable care and coverage, like the Primary Care Investment Act, Zero-copay Inhalers, the Fair Pricing Act, or setting up an independent Office of Health Care Affordability.

Many New Yorkers, who purchase their own health coverage through the New York State of Health marketplace, are eligible for subsidies. If you need help switching plans or finding affordable health insurance, the Navigators program offers free, unbiased guidance and can help you understand your premium assistance and coverage options. You can contact Navigators through the CSS Navigator Network at 888-614-5400 or email enroll@cssny.org.

With the recent release of the Senate and Assembly One-House budgets, HCFANY is excited to see some of our policy agenda items included. However, HCFANY is also disappointed that key proposals to protect and improve health care coverage for many New Yorkers were left out. Read below for HCFANY’s response to the One-House budgets:

HCFANY supports the following proposals in either the Assembly or the Senate One-House Budget or both:

- Strengthen maternal and reproductive health care access.

- Cover more lactation support services under Medicaid, including allowing certified lactation consultants to enroll as Medicaid providers and covering breast pump supplies.

Primary Care spending: In the United States, less than five cents of every dollar we spend on health care goes to primary care doctors and nurses, even though they handle a third of health care visits. In New York, nearly 70 percent of all emergency room visits are non-emergent and could be better treated in a primary care setting, over double the national rate. HCFANY strongly supports the inclusion of the provisions of the Primary Care Investment Act in the Senate’s One-House Budget, which requires insurance carriers to increase spending on primary care by one percent each year until they reach a target of 12.5 percent. Investment in primary care can reduce the prevalence of chronic diseases and overall health care spending. According to a recently released survey on health care affordability, 79 percent of New Yorkers support requiring insurance carriers to gradually increase spending on primary care. Many other states have also enacted similar policies requiring increased primary care spending (e.g., Colorado, Delaware, Oregon, and Rhode Island). New York should follow suit.

Maternal, reproductive, and lactation care: In New York, Black mothers are five times more likely to have a pregnancy-related death than their White counterparts. HCFANY strongly supports initiatives that tackle racial inequities within New York’s health care system and is excited to see greater and continued support from New York’s Legislature for maternal and reproductive health care. Almost half of births in New York are covered under Medicaid, and with current federal threats that may cut funding for Medicaid—providing health care access to around 7 million New Yorkers. New York can use the budget to safeguard access to care for many New York mothers.

HCFANY supports the following initiatives introduced in the Executive Budget but urges the Legislature and the Governor to adopt slight modifications in the final budget:

- Strengthen the New York Department of Health’s (DOH) oversight of material health care transactions and require public disclosure and allow public participation during the health care transaction process. A material health care transaction includes mergers, acquisitions, or a form of partnership with the purpose of administering contracts with health plans, third-party administrators, pharmacy benefit managers, or health care providers. What is excluded from this definition is partnerships for clinical trials or transactions that result in a health care entity increasing its total gross in-state revenue by less than $25 million.

HCFANY supports granting the DOH authority to determine a health care transaction’s potential market and cost impact and the post-closure impact on costs, quality, access, health equity, and competition. Additionally, the Executive budget proposes that transactions require written notice before the transaction closes to include whether either a party or parent company owns a health care entity that has closed, is in the process of closing, or has reduced its services provided. In the Senate’s One-House budget, HCFANY supports the addition of extending the notification time frame for closures from 60 to 90 days.

HCFANY, separately, urges the Legislature to make amendments to the language to improve transparency and consumer engagement for this process by (1) requiring full public disclosure of the material transactions, (2) extending the time to file such a transaction, and (3) allowing the public to provide input on the proposed transactions to the DOH, similar to the provisions of the Local Input for Community Healthcare Act (LICH) (S1226/A6004) passed by both houses of the Legislature and vetoed by the Governor last year. The LICH bill would require the approval of closures of a hospital or maternity, emergency, or mental health services to consider findings from a Health Equity Impact Assessment, and closures must be reviewed in public sessions by the State’s Public Health and Health Planning Council.

HCFANY is disappointed that the following initiatives are not included in the One-House Budgets:

- Include the No Blank Checks Act (S6375), which would create a uniform patient financial liability form that includes a good faith estimate of what a patient owes financially for the care or service they will receive.

- Include the Fair Pricing Act (S705/A2140), which would limit prices on routine medical services to 150% of the Medicare rate.

- Redistribute some of the $1.4 billion from Managed Care Organization (MCO) tax revenue for direct patient support and a rainy-day fund.

No Blank Checks: When patients walk into an appointment for a health care service, they are often required to sign a form agreeing to pay for any charges not covered by my insurance before they receive any care. This form legally binds them to pay for the service they get without knowing the outcome, how much will be covered by insurance, or whether their provider will bill correctly. It is essentially a blank check. The provisions of the No Blank Checks Act would create a uniform patient financial liability form that includes a good faith estimate of a patient’s financial obligation for their care. If patients are liable to pay for the service beforehand, health care services should inform them of how much it will cost. New Yorkers need greater price transparency, and many agree, as 92 percent of New Yorkers endorse requiring hospitals and doctors to provide up-front cost estimates to consumers.

Fair Pricing: According to 32BJ Health Fund claims data, the exact same service can cost $1,000 more at a hospital-owned outpatient department compared to a doctor’s office. Spending on hospital care is the biggest contributor to rising health care spending in New York, rising twice as fast as income and four times as fast as inflation. Rising prices directly affect New Yorkers as around two-thirds of them have experienced a health care affordability burden this year, with even more worried about affording care in the future. The Fair Pricing Act, which caps prices for routine services at a reasonable 150% of Medicare rates, would save the State an estimated $1.1 billion, $213 million of which would be saved annually by New Yorkers in reduced out-of-pocket costs. It is also supported by 86% of New Yorkers.

MCO tax: The MCO tax allows the State to draw down federal funds by taxing Medicaid and the Essential Plan MCOs to receive a federal match. The State then reimburses MCOs to make them whole and pockets the additional revenue. The Executive budget is allocating a significant portion of this revenue to hospitals. However, HCFANY urges the Governor and the Legislature to come together to reallocate some of these funds to support patients directly in the final budget. With federal threats to cut funding to Medicaid and Affordable Care Act health programs, the State can use this tax revenue to protect New Yorkers’ access to health care coverage by allocating some of this revenue to principal reserves or rainy-day funds. Medicaid provides health and financial security for seniors, children, and working-class families, and it is a critical source of funding for hospitals, clinics, community health centers, and long-term care facilities. The State should use the MCO tax revenue as an opportunity to prepare for potential cuts to federal health programs, including Medicaid.

- Worried about federal threats to health coverage? Call key New York Members of Congress today and ask them to stop federal threats to health care in order to pay for tax breaks for millionaires. They need to hear from New Yorkers on why they need to vote to protect our access to health care: click here.

- Learn how federal threats affect New York State and each of its congressional districts: click here.

Stay tuned for our comments on the final State budget releases.

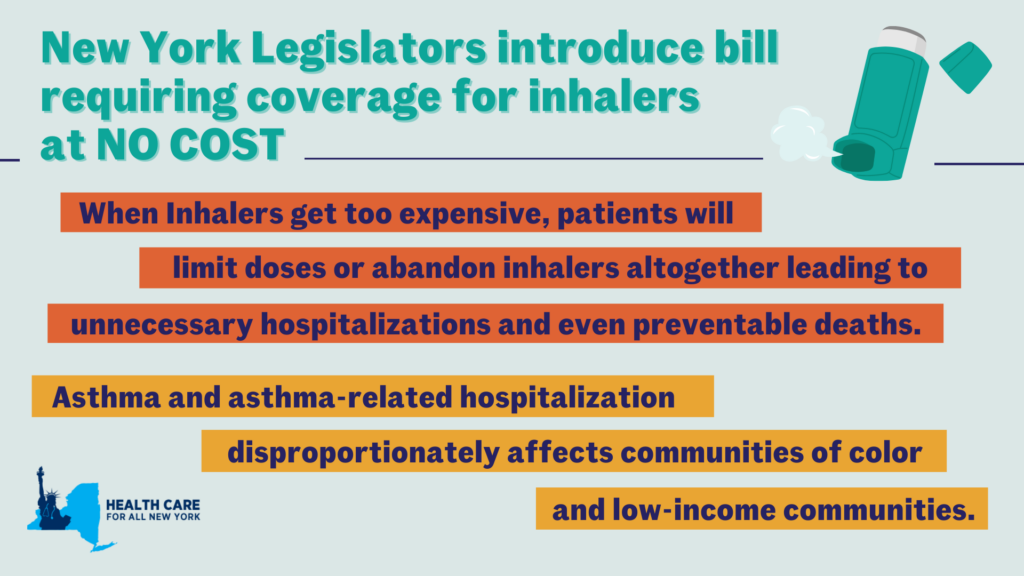

Every September, healthcare providers see a rise in asthma-related hospitalizations. The third week of September is known as Asthma Peak Week; ragweed levels—a common fall pollen allergy—are peaking, mold counts are increasing as leaves start to fall, children are catching respiratory infections as they go back to school, and flu season is just beginning. Proper asthma control is essential to stay healthy and manage symptoms during this month. However, for many, healthcare costs are making it difficult to manage or control their symptoms.

In New York, asthma impacts more than 1.4 million adults and an estimated 315,000 children, according to the New York State Department of Health and the US Center for Disease Control, respectively as of 2021. The price of asthma inhalers, a lifesaving and sustaining device, has drastically increased over the past decade and can cost an individual up to $645 a month, according to the Senate Committee on Health, Education, Labor and Pensions (HELP). At these high prices, some patients are rationing doses or even abandoning their inhalers—which can lead to unnecessary hospitalizations and even preventable deaths. Though with insurance, patients share the cost of an inhaler with their insurance provider through a deductible or copayment—even those with health coverage struggle to afford inhalers.

Asthma rates and asthma-related complications disproportionately affect communities of color and low-income communities in New York. Black New Yorkers are over nine times more likely to visit the Emergency Department (ED) for asthma-related complications than their White counterparts—four times more likely for Hispanic New Yorkers. Asthma-related ED visits are also three times as frequent for individuals in low-income zip codes when compared to those in higher-income zip codes. Asthma is an apparent public health issue affecting those already facing economic and environmental disparities.

Earlier this year, with pressure from the HELP committee and Senator Bernie Sanders, three of the largest producers of inhalers—AstraZeneca, Boehringer Ingelheim, and GlaxoSmithKline—agreed to cap their inhaler products, for both asthma and chronic obstructive pulmonary disease, at $35 or less per month. This price cap will be available for those on commercial insurance and those uninsured, which will be automatically applied at local pharmacies or accessed with a copay card. However, those enrolled in government insurance programs, like Medicare or Medicaid, are left behind due to federal restrictions.

Luckily, New York legislators, Assembly Member Jessica González-Rojas and State Senator Gustavo Rivera, have proposed a bill to remove this financial barrier by eliminating deductibles, copayments, coinsurance, or other cost-sharing requirements for inhalers and require insurance coverage for inhalers at no cost. González-Rojas introduced this legislation because of its significance to her district, representing communities in Queens, that have high rates of hospitalization due to asthma. Rivera represents the northwest Bronx, a borough with substantially higher asthma mortality rates than other New York City boroughs. We commend both González-Rojas and Rivera for taking these necessary actions in trying to address New York’s asthma crisis.

Minnesota and Illinois, Washington, and New Jersey have passed similar legislation that caps the cost-sharing requirements of inhalers at $25, $35, and $50 per month, respectively. We need New York to step up to the plate to save lives and treat asthma. “This smart bill will ensure that insurance cost-sharing is never a barrier to accessing life-sustaining inhalers for those who need it,” said Elisabeth R. Benjamin, Vice President of Health Initiatives at the Community Service Society of New York.