Read HCFANY’s 2024 Rate Review Comments

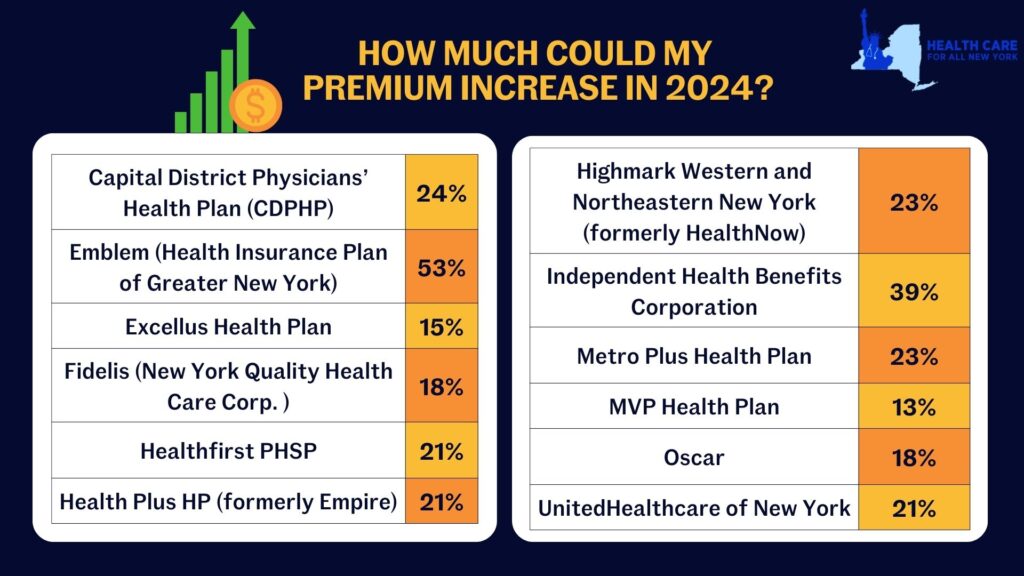

New York’s individual market premiums might increase by up to 20.4 percent in 2024. New York’s twelve individual market carriers are requesting increases ranging from 13.3 percent by MVP to a shocking 52.8 percent by Emblem. These requested increases far surpass requests from carriers in other states. Carriers in Washington and Michigan are proposing increases of just 9 percent and 5 percent respectively, despite having comparable individual markets.

Rate increases mean New Yorkers would spend a greater share of their budget on health care and less on food, transportation, and other necessities. New York insurance carriers have not offered adequate justification to support their exceedingly large requested price hikes, citing several market wide trends as rationale:

- End of the Covid-19 Public Health Emergency (PHE) – During the pandemic, New York stopped requiring people in public health insurance programs to renew (which requires verifying income). In the first two years of the pandemic, over 60,000 people left the individual market as they became eligible for Medicaid and the Essential Plan. Altogether 9.3 million New Yorkers are now renewing their coverage for the first time since 2020 and are doing so in an economy that is improved. Renewal over the next year will reveal higher incomes for many people, making them no longer eligible for public coverage and leaving them to return to the individual market. Based on enrollments so far, that could be 70,000 new people in the individual market. More people in the market should mean reduced premiums, and the Department should implement a uniform reduction to all carriers requested 2024 premium rates.

- Covid-19 Testing and Vaccination Costs – Spending on of Covid-19 treatment in 2024 is expected to be significantly lower than previous years because of the combined reduction in frequency and severity of Covid-19 cases in New York. Further, utilization is likely to decline because cost-sharing for Covid-19 testing and treatment is back, effective May 2023. Extensive research documents that even small amounts of cost-sharing reduce health care utilization. The Department should reduce the requested premiums to accurately reflect the change in costs and utilization of Covid-19 related services by individual market consumers in the 2024 plan year.

- 1332 State Innovation Waiver – The Waiver, which was filed with the federal government in May 2023, seeks to expand the Essential Plan from its current income eligibility cap from 200 to 250 percent of the federal poverty level. It is unlikely that all the procedural steps necessary to implement the Waiver will occur before the start of 2024. Given this uncertain timing, any adjustment for the Waiver should be delayed until 2025 when the State has certainty about whether the Waiver has been approved and when it is implemented.

In our comments, HCFANY breaks down why DFS should curb each carrier’s specific rate requests to protect patients from another unaffordable increase in health care costs. Find your carrier in the list below to see what we had to say:

- Independent Health

- MetroPlus

- CDPHP

- Emblem

- Excellus

- Fidelis

- Healthfirst

- Highmark

- HealthPlus

- MVP

- Oscar

- United

Tell the State how higher health care costs would impact you here. You can also tell DFS Superintendent Adrienne Harris or Deputy Superintendent John Powell to lower rates on social media by tagging @NYDFS.

It is a great day for New Yorkers. The Cuomo Administration announced that it has slashed insurance companies’ proposed rate hikes by over 50 percent for people covered through the New York State of Health Marketplace and in the individual and small group markets.

“This is great news for consumers and small employers alike,” said Elisabeth Benjamin, a co-Founder of Health Care for All New York and Vice President of Health Initiatives at the Community Service Society of New York. “The Cuomo Administration has effectively applied the law to control premium costs—and this translates into $1 billion in real savings for New Yorkers.”

New York’s carriers had sought an average 12.5 percent rate increase on the rates individual consumers pay, but the Department of Financial Services approved an average 5.7 percent increase – consistent with the 4.2 percent rate increase approved by the Cover California’s Marketplace. Likewise, the Department cut the average 13.9 percent increase sought by carriers in New York’s small group market to 6.7 percent.

“This news proves the value of an open and transparent rate review process,” said Mark Scherzer, Legislative Counsel for New Yorkers for Accessible Health Coverage and co-Chair of HCFANY’s Policy Committee.

To view a chart of insurers’ approved rates by region, please visit DFS’ website.

A press release issued by Governor Cuomo’s office yesterday announced that New Yorkers will save over $500 million on health insurance premiums this year thanks to the Department of Financial Services’ (DFS) utilization of the State’s prior approval law. As you may remember, New York’s 2010 prior approval law allows DFS officials to review insurance rate increases before they go into effect and scale them back if they are too high.

Health insurers had requested overall increases averaging around 12.4%, which were then cut down to an average of 7.5% by DFS. Rate increases for small group plans will increase an average of 9.5%, down from the average 15.7% increase requested by the insurance plans. Prior to passage of the prior approval law, annual premium rate increases averaged 14%.

These modest increases stand out at a time when many states are experiencing double-digit increases in premiums. For example, an article in Saturday’s New York Times notes that states like Florida and Ohio have seen rates rise by as much as 20%, with similar rate increases proposed in California.

The Affordable Care Act requires states to review any proposed rate increases above 10%, however New York is one of 37 states which allows state officials to deny excessive rate increases (an issue that is explored further in the Times article).

So, thanks again to our Senate Democrats who really championed this issue back in 2010 and made savings like this possible today. We appreciate the work you do!!!

See below for a breakdown of the average requested rate increase and what the DFS ended up actually approving. For the full list of increases by insurance plans, see the Governor’s press release.

| Health Insurance Market Segment |

Total Number

of Members Affected |

Requested Annual Rate Increase (Weighted Average)

|

Approved Annual Rate Increase (Weighted Average)

|

Reduction by DFS

|

| Individual, direct-pay |

52,383

|

+9.54%

|

+4.48%

|

-5.06%

|

| Small Group |

1,280,649

|

+15.77%

|

+9.59%

|

-6.18%

|

| Large Group |

611,780

|

+7.84%

|

+5.20%

|

-2.64%

|

| HealthyNY |

117,859

|

+24.84%

|

+11.81%

|

-13.03%

|

| Medicare Supplement |

319,722

|

+3.27%

|

+2.59%

|

-0.68%

|

| Overall |

2,382,393

|

+12.37%

|

+7.52%

|

-4.85%

|

Click here to read the Governor’s press release.

Click here to read the NYTimes article, titled “Health Insurers Raise Some Rates by Double Digits.”

That’s right – its health insurance rate review time! This means that our health insurance plans are now diligently submitting their proposed rate increases to the Department of Financial Services (DFS) for approval. Some of you may have already received a letter from your health plan letting you know that they plan to “adjust” your premium rate. Health plans are required to give you 120 days notice of any proposed rate increases (and 60 days notice before the approved increase goes into effect).

That’s right – its health insurance rate review time! This means that our health insurance plans are now diligently submitting their proposed rate increases to the Department of Financial Services (DFS) for approval. Some of you may have already received a letter from your health plan letting you know that they plan to “adjust” your premium rate. Health plans are required to give you 120 days notice of any proposed rate increases (and 60 days notice before the approved increase goes into effect).

It’s up to DFS to decide whether the proposed rate increases are necessary. Comments and objections from policyholders and the public can be submitted for up to 30 days after a health plan submits its application for an increase. You can find any pending rate increase applications, and supporting documentation, on the DFS website by clicking here.

HCFANY is, of course, on top of this and is once again submitting comments on proposed rate increases. First on the agenda is Oxford/United Healthcare, which is requesting rate increases of between 15.1% and 46.5% for its various small groupproducts. After combing through the supporting documentation provided by the plan – particularly around medical trend and member migration – we are not convinced that that increases of this magnitude are necessary. Our recommendation to the DFS is that the proposed rate increases be denied.

If you’d like to submit your own comments to the DFS, you can do so online by clicking here, or via regular mail to:

Mr. Charles Lovejoy

Health Bureau

New York State Department of Financial Services

25 Beaver Street

New York, NY 10004