Read HCFANY’s 2024 Rate Review Comments

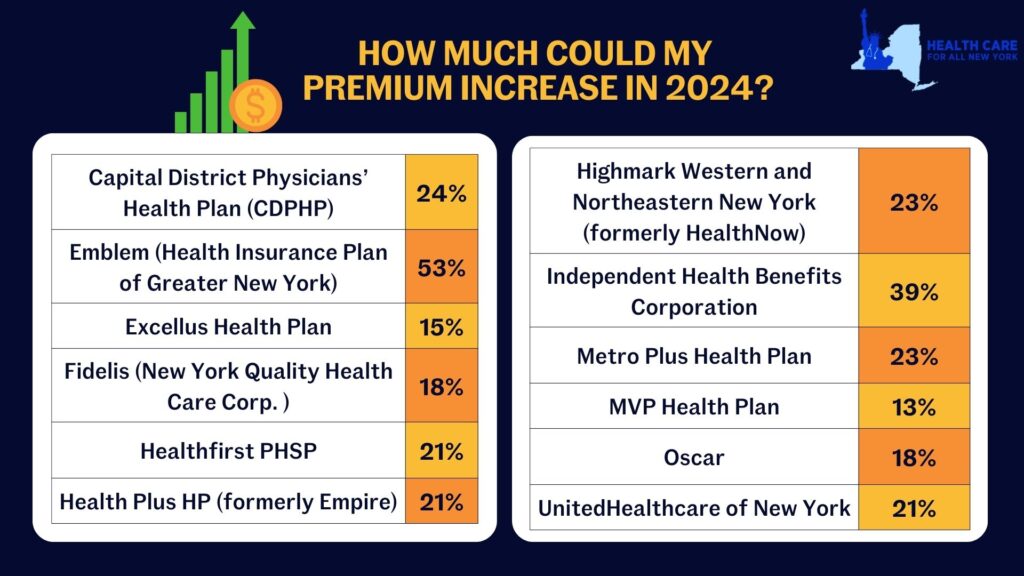

New York’s individual market premiums might increase by up to 20.4 percent in 2024. New York’s twelve individual market carriers are requesting increases ranging from 13.3 percent by MVP to a shocking 52.8 percent by Emblem. These requested increases far surpass requests from carriers in other states. Carriers in Washington and Michigan are proposing increases of just 9 percent and 5 percent respectively, despite having comparable individual markets.

Rate increases mean New Yorkers would spend a greater share of their budget on health care and less on food, transportation, and other necessities. New York insurance carriers have not offered adequate justification to support their exceedingly large requested price hikes, citing several market wide trends as rationale:

- End of the Covid-19 Public Health Emergency (PHE) – During the pandemic, New York stopped requiring people in public health insurance programs to renew (which requires verifying income). In the first two years of the pandemic, over 60,000 people left the individual market as they became eligible for Medicaid and the Essential Plan. Altogether 9.3 million New Yorkers are now renewing their coverage for the first time since 2020 and are doing so in an economy that is improved. Renewal over the next year will reveal higher incomes for many people, making them no longer eligible for public coverage and leaving them to return to the individual market. Based on enrollments so far, that could be 70,000 new people in the individual market. More people in the market should mean reduced premiums, and the Department should implement a uniform reduction to all carriers requested 2024 premium rates.

- Covid-19 Testing and Vaccination Costs – Spending on of Covid-19 treatment in 2024 is expected to be significantly lower than previous years because of the combined reduction in frequency and severity of Covid-19 cases in New York. Further, utilization is likely to decline because cost-sharing for Covid-19 testing and treatment is back, effective May 2023. Extensive research documents that even small amounts of cost-sharing reduce health care utilization. The Department should reduce the requested premiums to accurately reflect the change in costs and utilization of Covid-19 related services by individual market consumers in the 2024 plan year.

- 1332 State Innovation Waiver – The Waiver, which was filed with the federal government in May 2023, seeks to expand the Essential Plan from its current income eligibility cap from 200 to 250 percent of the federal poverty level. It is unlikely that all the procedural steps necessary to implement the Waiver will occur before the start of 2024. Given this uncertain timing, any adjustment for the Waiver should be delayed until 2025 when the State has certainty about whether the Waiver has been approved and when it is implemented.

In our comments, HCFANY breaks down why DFS should curb each carrier’s specific rate requests to protect patients from another unaffordable increase in health care costs. Find your carrier in the list below to see what we had to say:

- Independent Health

- MetroPlus

- CDPHP

- Emblem

- Excellus

- Fidelis

- Healthfirst

- Highmark

- HealthPlus

- MVP

- Oscar

- United

Tell the State how higher health care costs would impact you here. You can also tell DFS Superintendent Adrienne Harris or Deputy Superintendent John Powell to lower rates on social media by tagging @NYDFS.

Insurers offering products in New York’s individual, small group, and Medicare Advantage markets submit applications to the Department of Financial Services (DFS) each year which describes how premiums will change and why. DFS (and HCFANY!) encourage consumers to respond to these requests by share their experiences with DFS. How affordable do you think your current plan is? What would happen if your premiums went up as much as your insurer asks for? You can read HCFANY’s guidance for how to comment here, and submit your comments to DFS here.

Insurers have requested an average increase of 11.2% for 2022 on the individual market, which is very high given that consumers are still navigating the economic and health-related repercussions of the COVID-19 pandemic; in addition, insurers will likely continue to benefit financially from depressed utilization and the increased use of telehealth as a result of the pandemic. In some cases insurers didn’t give enough information about why they think premiums should increase. This isn’t fair to the public.

In our comments, HCFANY discussed many reasons why DFS should consider reducing the rate requests, including both market-wide conditions and specific factors in each insurer’s application. Find your carrier in the list below to see what we had to say!

- CDPHP Health Plan

- Excellus

- Emblem (HIP)

- Fidelis

- Healthfirst

- Highmark Western and Northeastern New York (Formerly HealthNow)

- HealthPlus (previously Empire)

- Independent Health Benefits Corporation (IHBC)

- MetroPlus

- MVP Health Plan

- Oscar

- UnitedHealthcare

Premium requests made by New York’s insurance companies have been posted, and consumers have the chance to share their thoughts on these requests! New York State requires this approval for all individual market, small group, and Medicare Advantage plans. If your plan is part of this process, you should have received a letter from your insurer explaining what they requested and how you can submit comments to the state’s Department of Financial Services (DFS). The insurers’ applications are available through DFS’s website and are linked below. Public comments are due in late June and can be submitted online here.

It is important to remember that at this point, these are only requested changes; DFS will review insurers’ applications along with consumers’ comments when determining the approved rates for 2022. Last year, DFS decreased insurers’ requested rate for individual coverage from a 11.7 percent increase to a 1.8 percent increase, the lowest rate increase ever approved. The changes saved consumers over $221 million. DFS also reduced rates requests for small group coverage from 11.4 percent to 4.2 percent, a 63 percent decrease that saved small businesses over $565 million.

This year, the average request was 11.2 percent in the individual market. Healthfirst PHSP, Inc. requested the highest increase at 34.4 percent. The plan cites higher provider charges in its new service areas in Westchester and Rockland counties for most of this increase. Six other plans requested double digit increases: Highmark (18.1 percent), MVP (16.9 percent), Unitedhealthcare (13.9 percent), Oscar (13.6 percent), CDPHP (11.4 percent), and HealthPlus (10.2 percent). MetroPlus (-3.9%) and Independent Health Benefits Corporation (-.2%) each requested decreases. For small group plans, the average requested increase was 14 percent, ranging from a 17.6% requested increase by Highmark Western and Northeastern New York (formerly Healthnow) to a 4.5% requested decrease by Aetna Health.

HCFANY submits detailed comments each year, which you can see in our letters from 2020 (link) and 2019 (link). Consumers do not need to provide this much detail; if you do comment publicly, you can speak about how the proposed changes to your plan would impact you. For example, what changes would you have to make if your insurance company were allowed to increase their rates? Would you still buy insurance? HCFANY has longer instructions available (link), but the most important thing is to use your own experience.

Individual Market Applications

We’ve compiled the links to applications for each insurance carrier that participates in New York’s individual market through our health insurance exchange below. We’ve included both the narrative summaries, which are shorter (under 10 page) explanations for the requested rate changes, as well as the complete application links for those who wish to review the applications in greater detail.

- CDPHP Health Plan: Narrative Summary (link), Complete Application (link)

- Emblem (HIP): Narrative Summary (link), Complete Application (link)

- Excellus: Narrative Summary (link), Complete Application (link)

- Fidelis (NYHQC): Narrative Summary (link), Complete Application (link)

- Healthfirst PHSP: Narrative Summary (link), Complete Application (link)

- Highmark Western and Northeastern New York (Formerly HealthNow): Narrative Summary (link), Complete Application (link)

- HealthPlus Empire: Narrative Summary (link), Complete Application (link)

- Independent Health Benefits Corporation: Narrative Summary (link), Complete Application (link)

- MetroPlus: Narrative Summary (link), Complete Application (link)

- MVP Health Plan: Narrative Summary (link), Complete Application (link)

- Oscar: Narrative Summary (link), Complete Application (link)

- UnitedHealthcare of New York: Narrative Summary (link), Complete Application (link)

If you tuned in to Governor Cuomo’s State of the State address today, you heard him say that he will eliminate premiums for 400,000 New Yorkers! HCFANY applauds this proposal which will eliminate the $20 monthly premium for some Essential Plan enrollees with incomes up to $25,500 per year. Currently, people with household incomes at 150-200% FPL ($25,520 for a single person or $52,400 for a household of four) pay a $20 monthly premium for Essential Plan coverage.

While a $20 premium may seem relatively affordable, it results in nearly 100,000 New Yorkers per year losing coverage for failing to pay. This proposal, which is mostly federally funded, can be implemented without a huge price tag for New York’s tax payers.

The legislature should move quickly to adopt Governor Cuomo’s proposal to ensure nearly all low-income New Yorkers can access premium-free coverage. Now let’s just try to do the same for immigrant New Yorkers who remain ineligible.