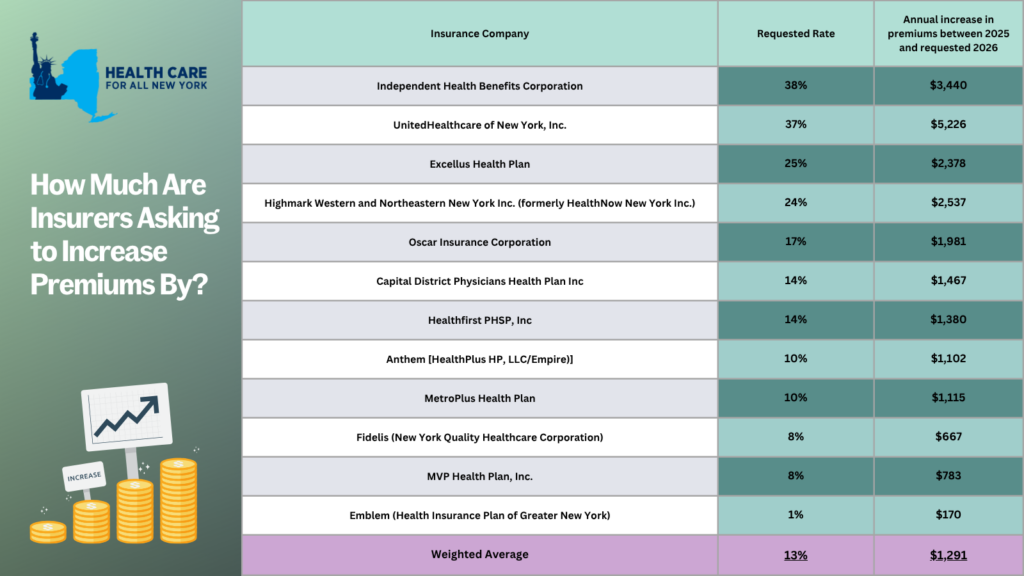

New York’s individual market premiums might increase by up to 13 percent in 2026, forcing consumers to pay an extra $1,291 more annually. New York’s twelve individual market carriers are requesting increases ranging from one percent by Emblem to a staggering 38 percent by Independent Health. These requests far surpass requests from carriers in other states.

In our comments, HCFANY breaks down why DFS should curb each carrier’s specific rate requests to protect patients from another unaffordable increase in health care costs. Find your carrier in the list below:

- Anthem

- CDPHP

- Emblem

- Excellus

- Fidelis

- Healthfirst

- Highmark

- Independent Health

- MetroPlus

- MVP

- Oscar

- United

New York’s individual market insurance carriers have asked the Department of Financial Services to allow them to increase premiums by an average of 13% in 2026. This increase would force New Yorkers to pay an average of $1,291 more annually, or $108 monthly, in premiums.

For the next 30 days, starting June 2nd, consumers can make their voices heard by weighing in on the prior approval process.

For the past two years, the State has approved a steep premium increase of 13% in 2025 and 12% in 2024. Another 13% would make health care access even more difficult to reach for many New Yorkers. This percentage increase is greater than wage growth in New York in 2024, as wages have only grown from .4% to 4.6% across the State, depending on the county.

Based on your carrier, premiums could increase between 1% and 38% in 2026, inhibiting New Yorkers’ ability to spend on other essentials like groceries, transportation, or housing. It is critical that the State hears from consumers to ensure that health insurance companies are not making health care even more unaffordable.

Make your voice heard: submit a public comment before July 1, 2025, sharing how steep premium increases would impact your budget or loved ones.

Tell the State how more expensive premiums would impact you by leaving a public comment here by Tuesday, July 1. Share a statement or story on your health care needs and affordability concerns you have, or use the following sample for guidance:

“My plan, (insert carrier name), has asked for a (insert from table below) % premium increase. This would increase my annual premiums by (insert from table below). I already struggle to afford health insurance, and that increase would require me to sacrifice ____.”

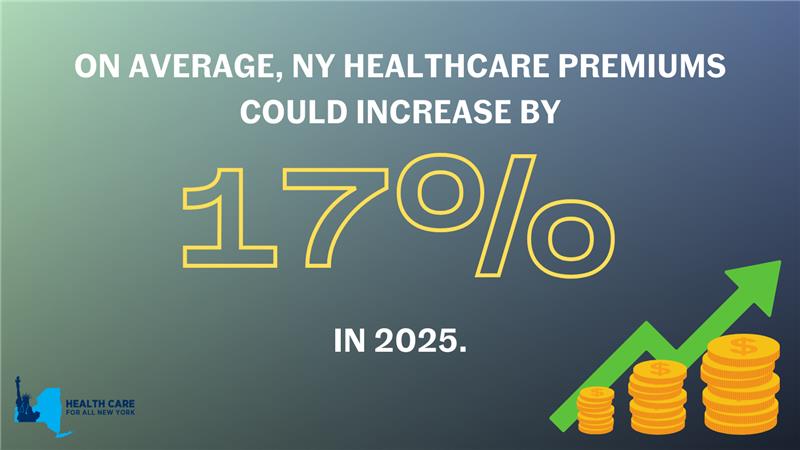

New York’s individual market insurance carriers plan to increase premiums by an average of 17% in 2025. This month, consumers have the opportunity to weigh in to make our voices heard. The State already approved premium increases of over 14% on average in 2024, another 17% would make health insurance out of reach for many New Yorkers.

Depending on your carrier, premiums could increase between 9% and 51% in 2025, impacting New Yorkers’ ability to spend on necessities such as health care, groceries, and transportation. It is critical that consumer voices are heard to prevent health insurance from being even more unaffordable.

Make your voice heard: submit a public comment before June 28, 2024 sharing how steep premium increases would impact you and your loved ones.

Tell the State how more expensive premiums would impact you by leaving a public comment here by Friday, June 28. Share a personal story on your healthcare needs and affordability concerns you have, or use the following sample for guidance:

“My plan, (insert carrier name), has asked for a (insert from table below) % premium increase. I already struggle to afford health insurance and that increase would require me to sacrifice ____.”

New Yorkers bracing for health insurance premiums in the individual market are in for some unwelcome news as we look ahead to 2024. According to the latest data, individual market rates are set to surge by an average of 12.4 percent next year. Health plans had initially requested a whopping 22.1 percent average rate hike for 2024, but the Department of Financial Services has managed to trim down this figure through New York’s prior approval process.

The table below presents a comparison of the health plans’ original rate hike requests and the rates that were ultimately approved, giving you insight into how the process affects your healthcare costs. (Feel free to refer to our detailed comments on each rate request.)

The prior approval process serves as a critical safeguard; however, the 12.4 percent increase still poses a financial challenge for many New Yorkers. It underscores the need for New York to explore additional measures to protect consumers from steep premium rises outside of the rate review process. States like Connecticut, Delaware, Massachusetts, Nevada, New Jersey, Oregon, Rhode Island, and Washington have already taken steps in this direction, establishing Health Care Cost Containment task forces or agencies.

For those concerned about the affordability of health insurance, there’s some relief to be found. Most New Yorkers purchasing their own health coverage qualify for subsidies that can help offset premium costs. To explore your options and find out more about available subsidies, head over to the NY State of Health enrollment site. If you need assistance with switching plans or enrolling in affordable health insurance, the Navigator program is here to help. Navigators provide free, unbiased enrollment assistance and can help you understand your eligibility for premium assistance and your coverage options. You can reach out Navigators in the CSS Navigator Network at 888-614-5400 or drop them an email at enroll@cssny.org. You can reach out to assistors with the NY State of Health online here or call at 855-355-5777.

| 2024 Individual Market Rate Changes | |||

| Plan | Requested Increase | Approved Increase | Change |

| Emblem/HIP | 52.7% | 25.1% | -52.4% |

| IHBC | 39.2% | 25.3% | -35.5% |

| MetroPlus | 26.4% | 17.6% | -33.3% |

| CDPHP | 23.5% | 12.1% | -48.5% |

| Highmark | 22.6% | 13.0% | -42.5% |

| Healthfirst | 20.9% | 12.5% | -40.2% |

| UnitedHealthcare | 20.9% | 12.2% | -41.6% |

| Anthem (Formerly Empire HealthPlus) | 20.7% | 8.6% | -58.5% |

| Oscar | 18.4% | 7.9% | -57.1% |

| Excellus | 15.2% | 12.2% | -19.7% |

| MVP | 13.3% | 6.5% | -51.1% |

| Overall | 22.1% | 12.4% | -43.9% |